K V Kamath Committee Ratios

The reserve bank of india rbi on monday said that it has broadly accepted the recommendations of the k v.

K v kamath committee ratios. Current ratio which is current assets. The committee has recommended financial ratios for 26 sectors which could be factored by lending institutions while finalizing a resolution plan for a borrower. Current ratio which is current assets.

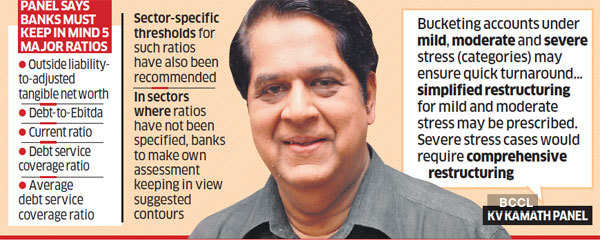

The kamath panel has recommended financial ratios for 26 sectors which could be factored by lending institutions while finalizing a resolution plan for a borrower the financial aspects include. The kv kamath committee along with members ashwin parekh divakar gupta ca t n manoharan sunil mehta recommended five financial ratios for the stressed 26 sectors for lenders to consider while finalizing resolution plans. The committee headed by veteran banker kv kamath has recommended financial ratios for 26 sectors which could be factored in by lending institutions while finalising a resolution plan for a.

Iron steel manufacturing 4. The committee headed by k v kamath has said only those borrowers who were classified as standard did not default and with arrears less than 30 days as of march 1 2020 should be eligible under. The recommendations of the committee have been broadly accepted.

Key financial ratios suggested by the kamath committee include total outside liabilities adjusted tangible net worth tol atnw. These key financial ratios suggested by the kamath committee are total outside liabilities adjusted tangible net worth tol atnw. The committee has recommended financial ratios for 26 sectors for the purpose of recommending financial parameters to be factored in the resolution plan viz 1.

These key financial ratios suggested by the kamath committee are total outside liabilities adjusted tangible net worth tol atnw. Total debt ebitda. Total debt ebitda.

Total outside liability adjusted tangible net worth. The five ratios listed by the committee are.